As the industry chatter – driven by relentless messaging from Google – revolves increasingly around Smart Bidding options that take bid adjustment levers out of your hands, Google nonetheless continues to layer in more precision in some aspects of the Google Ads interface (and the associated API environment).

To continue beating the drum on this subject, Smart Bidding:

- Doesn’t seem nimble; often takes ages to learn and to adjust to anomalous circumstances known well to marketers;

- Seems to do exponentially better with enormous sums of data – not only very large accounts and datasets, but even within that environment, new learnings that emerge over the course of a full year. It appears nearly any degree of Bigness of Big Data leaves yet more room for improvement as the data gets even bigger.

- Yet Google and some others portray machine-learning-driven budget allocation as the blanket solution to almost any goal, regardless of quirky niche.

- That’s satisfactory to many advertisers, because they can’t find quality help and they don’t have the first clue how to master the platform themselves. A mediocre, overrated bot might well beat a crap human.

- That being said, there are strong use cases for Smart Bidding all over the place. But in other cases, you’re much better off grabbing the reins.

Geo-sensitive targeting and bid-adjusting is a must for some accounts, and amounts to an incremental win for others. Business profit is often found in the increments.

But how should this be tackled? It obviously varies enormously by industry.

To take the example of a typical broad-based e-commerce effort, I’d wager that, of the many potential permutations of geo-targeting setup and bid adjustment strategy, some will be much superior to others in terms of both workflow and performance. And yet the details are rarely discussed in our industry.

I like that there is “no one right way.” It’s great to Poke the Box. But some ways must be better than others. “Best” often results from arbitrarily making compromises. Perfection isn’t worth the time and expense it might require to achieve.

On one hand, it’s tempting to poke fun at a very generic approach to geo-precision in the U.S. context, such as specifically bidding 20 or so states, or all 50, with maybe a couple of large cities like Los Angeles and New York thrown in, observed, and adjusted. That wouldn’t be terrible, of course. You can’t go too far wrong.

But profitable anomalies could crop up at a more granular level. In particular, within a state like Minnesota or Colorado, there could be significant differences between performance in the city, in the suburbs, and “everywhere else.” “Everywhere else” in geo targeting is a handy way to simplify your life – the classic Google Ads “catch-all” or “backstop” that also lurks in other elements of campaigns such as search queries and the “Everything Else” in terms of product ID’s within Google Shopping.

I tend to believe it’s impractical for most account managers to obsess over these things. I mean, you’re going to be a really dull conversation partner at parties if you’re boning up on the ins and outs of Medina, MN. Is it a suburb? Are there farms? Is it close to the Mall of America? The airport? All of the above. Who knows? In the United States, there are thousands of municipal entities of comparable size to ponder.

Start and narrow

Perhaps, then – at least to start – a good approach in the context of a national campaign would be to try specifically bidding up or down on 20-30 states — those that are either very large or have shown significant deviations from average performance in the past.

State-level bidding is likely too diffuse, though, if that’s all you ever do. States are far from homogeneous in their behaviors and proclivities, as I don’t need to explain to you.

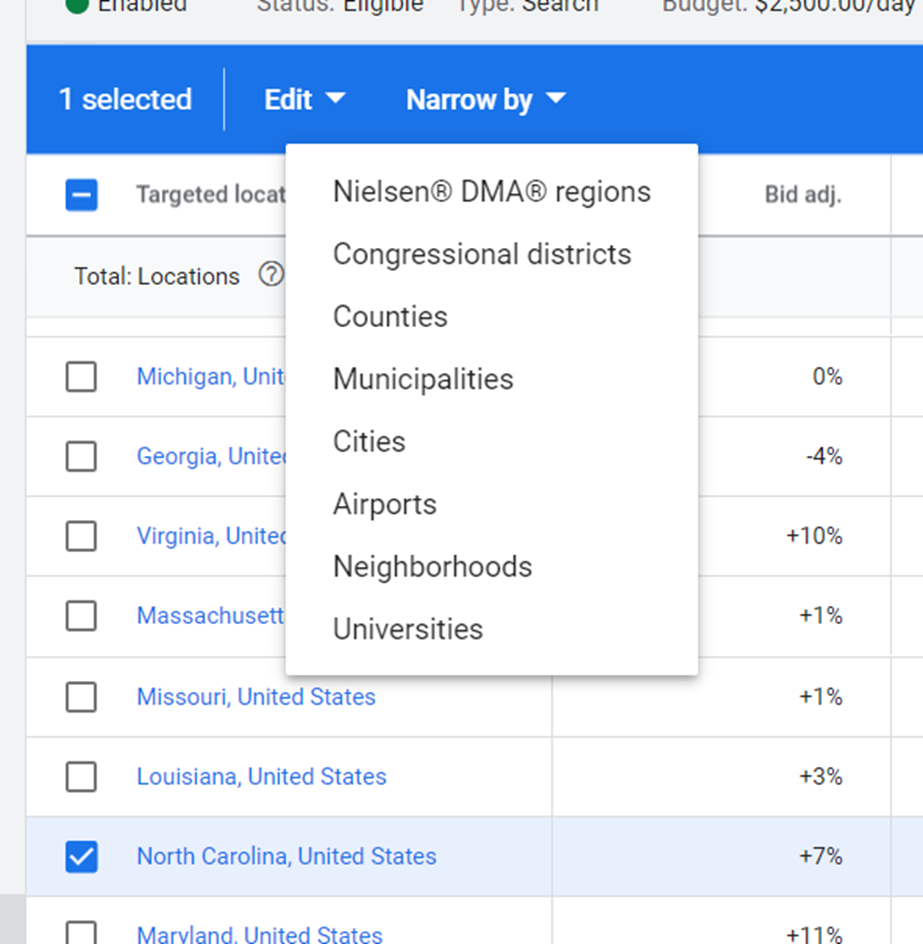

Figure 1: Research how to refine your existing geotargeting, and then enable the new subdivisions, with a couple of clicks!

Google Ads now makes it a snap to layer in some more specific geo subdivisions, with a relatively recent addition to the interface called “Narrow By.” You can go to the large metropolitan areas referred to as “DMA” – I’d recommend doing so for simplicity’s sake at first. (These are “designated market areas” as determined by the Nielsen company, apparently.)

Whether it’s DMA or something smaller, Google immediately brings up the data for all available subdivisions (it could be a large number of subdivisions if it’s a ZIP or postal code, but for DMA’s, a given state could have as few as one or two).

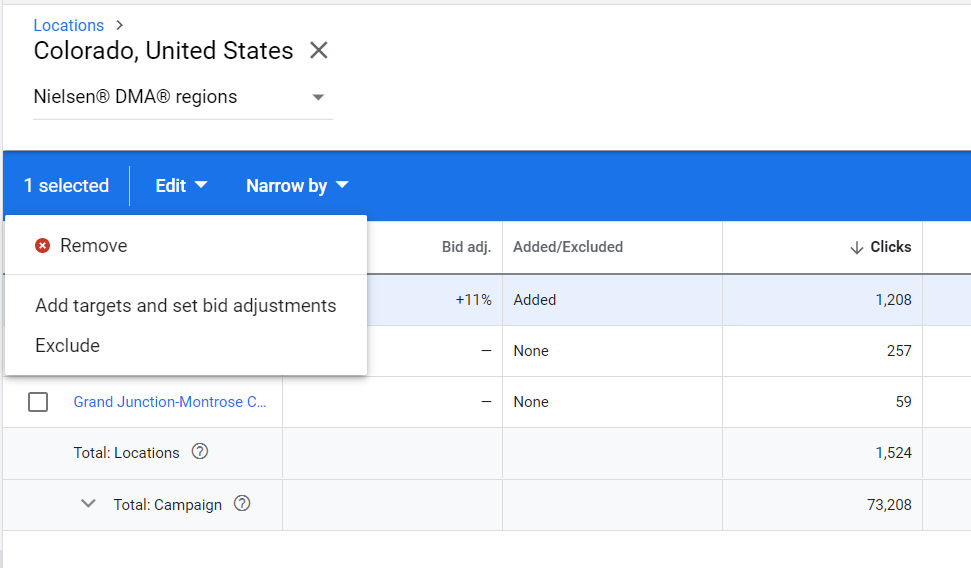

Colorado presents an interesting example. Google brings up three available DMA’s for the state. Two of them seem too small to reliably bid-adjust, so we’d just go with Denver (which, after noting that Boulder isn’t mentioned anywhere, we must assume incorporates Boulder in its monster DMA).

For this sample client, Denver DMA is pulling a 4.48 ROAS over a solid date range, vs. the statewide average of 4.13. After clicking it, click on “Edit,” then on “Add Targets and Bid Adjustments,” and you’re on your way!

Figure 2: Workflow has improved with the Narrow By sequence.

Continue doing this as time allows. And of course, monitor and bid-adjust periodically to hit your target KPI’s. Those are the “reins” and “levers” we keep talking about.

Read Part 45: Conversion Rate Problems You Can Solve At Your End